Frequently Asked Questions

General

A. Yes. Step One Finance is based in Woking, Surrey and was established in the UK in 2010. We are regulated by the Financial Conduct Authority for our second charge loans secured on residential property and unsecured personal loans. Click on “About Us” to find out more about Step One Finance.

A. Step One Finance has a range of products to suit many of our clients with different circumstances. We will be able to tell you if we have a suitable product once you have completed our online application for a personal loan or go through a decision in principle process with a Step One Finance customer service adviser, for one of our second mortgage loans.

A. No. Step One Finance only offers loans and mortgages where you repay a portion of the capital and interest each month. This ensures the loan you take out with us is repaid at the end of the term.

A. Complaints can be submitted by writing to us at the address below or by emailing complaints@steponefinance.co.uk. If we cannot resolve your complaint, you may have the right to refer your complaint to the Financial Ombudsman Service. The Financial Ombudsman can only consider complaints from eligible complainants. You can write to the Ombudsman at Exchange Tower, London, E14 9SR or visit their website at financial-ombudsman.org.uk.

A. The Step One Base Rate has been introduced to provide greater transparency to our customers around rate changes in our variable interest rate products and to better match the cost structure of our funding. More information can be found on the Step One Base Rate page

A. We use a combination of Experian, Equifax and Transunion as our credit reference agencies (CRAs). Their details are below.

Equifax Limited, Credit File Advice Service, PO Box 1140, Bradford, BD1 5US.

www.equifax.co.uk Tel: 0800 014 2955 or 0333 321 4043

Transunion International UK Ltd, One Park Lane, Leeds, West Yorkshire, LS3 1EP. www.transunion.co.uk/ Tel: 0330 024 7574

Experian Ltd, Consumer Help Service, PO Box 9000, Nottingham, NG80 7WF

www.experian.co.uk Tel: 0800 013 8888

A. Customers should do the due diligence of prospective lenders before applying for a loan. Just as lenders must know their customers before advancing a loan, borrowers should take the effort of checking the credentials of lenders to avoid being defrauded and ensure the company has the authority to lend the money. This can be done by simply checking the registration status of the lender on the Financial Conduct Authority register and Company House register. All legal lenders must display their company identification number and details of the certificate of registration.

While digital innovation has made it possible for lenders to offer loans speedily, lenders that use such high-pressure tactics could be up to no good. It may be a ploy to get people to make a rash decision without having time to do research to uncover the scam they’re running. Check if the service is legitimate, don’t fall for the urgency plea.

Always read the privacy policy since it is mandatory to be published on the website. Check if the interest and fees are mentioned transparently. All lenders are required to share a loan agreement with borrowers. If such a loan agreement, incorporating all detailed terms and conditions is not made available, a borrower should not take the loan. If a lender fails to reveal all terms of the loan, including the repayment amount, duration, interest, and late fees, it indicates there is something wrong.

There should be no pressure on applicants to act immediately, nor should there be any promise of guaranteed loan approvals without due diligence of an applicant’s creditworthiness. Reputable lenders make it clear that they need to look at your credit report (Equifax, TransUnion and Experian) as they need to ensure the financial history is in line with their risk appetite. When bad credit is considered, details about income, employment and expenditure will be considered when determining your eligibility.

Fraudsters have been known to require prepaid debit cards, gift cards or banking information from borrowers. Generally, the scammers claim they need the information for insurance, collateral or fees. Legitimate financial institutions may charge a fee for your application, appraisal or credit report, but they should offer you the option to add those charges to your loan, not require you to pay them upfront.

Some scammers go to great lengths to steal from consumers, including using a legitimate lender’s name. It’s also not uncommon for scammers to swap out the name and number that shows on your caller ID to trick you into believing they’re the real deal. You can protect yourself by ignoring solicitations and contacting the lender directly via their secured website or by calling the online customer service number. If the lender has no record of reaching out to you, that’s your confirmation that you were dealing with a fraudster.

Customers can also obtain additional information on the FCA’s website on the dangers of Loan Fee Fraud by clicking here.

A. We adhere to strict regulations set by regulatory authorities, which require us to identify and verify the source of funds being used in financial transactions. This is to prevent financial crimes such as money laundering, fraud, and financing of terrorism. By collecting information about the source of funds, we can ensure that all our customers are using legitimate funds and that our systems remain secure. We understand that collecting this information can be time-consuming, but please know that it is a legal and regulatory requirement that we must adhere to. Your cooperation in providing the required information is greatly appreciated and will enable us to continue providing you with the best possible service.

If you plan to redeem your mortgage account independently, with no Solicitor acting on your behalf, we must obtain the source of funds under current legislation. Please provide us with the relevant documents from the list below to provide evidence of the source of funds used to fund your transaction.

Please note that the following is only an indicative list, and we may need to ask for more information or evidence to verify the documents provided.

| Source of Funds | Evidence Required |

| Savings | Accumulated savings Recent copies of consecutive bank statements showing the build-up of savings. Please note that statements must be on bank-headed paper. Internet statements that do not show the account holder’s name, bank account number, name and address will need to be verified by the bank. Large deposits Where a large deposit has been credited to the bank account, additional documentary evidence will be required to verify its source. Our Customer Services team will be able to help with what documents would be appropriate for each circumstance. |

| Sale of Property | Signed letter from Solicitor or Estate Agent / Contract of sale/ Completion statement. |

| Sale of Investments | Statement from investment provider. |

| Maturity or surrender of life or endowment policy | Maturity statement or letter from the policy provider. |

| Inheritance | Copy of will /signed letter from Solicitor/Grant of probate/Executor`s letter. |

| Gifts | Gift letters, along with the bank statement of the person making the gift. |

| Sale of vehicles | Bank statement showing deposit of the proceeds of the sale. V5C logbook copy. |

| Settlement of loan by parents or other relatives |

Bank statement of the parent(s)/relative making the payment, clearly showing their name, address, and amount debited in their account on bank-headed paper. A signed note from the parent confirming the payment on behalf of the customer. Proof of ID of the parent/relative. |

| Sale of Business | Business banking statements. |

We assure you that all the information we receive will be kept secure, confidential and only used for regulatory compliance. We appreciate your cooperation in helping us maintain the integrity of our business and comply with regulatory guidelines.

Should there be any questions, please call our Customer Services team on 01483 661100.

Homeowner Loans (Second Mortgages Loans)

A. A second mortgage loan is secured against your home in the same way as your first mortgage. Your property or home may be repossessed if you do not keep up repayments on your mortgage.

A. You can apply for a Step One Finance second mortgage loan if:

i. You already have a first charge mortgage on your home

ii. Hold a UK Bank account and receive income in British pounds sterling

iii. Are over 21 years old

iv. Are a UK resident with a residential property in England, Wales or Scotland

All loan applications are subject to status.

A. Yes. It takes longer to arrange a loan secured against your home because we take extra care to ensure you can meet all your commitments and we have to consider the suitability of your property as well as your personal circumstances. On average, we take 3 – 4 weeks to complete our second mortgage loans.

A. The outstanding loan balance is on your annual statement. If this is out of date or you don’t have one, please contact our customer services team on 01483 661 100.

A. In order to understand how your loan balance reduces over time it is important to first understand how your monthly mortgage payment is calculated. With a capital repayment loan a portion of your monthly payment is applied to the interest due and the remainder is applied to reduce the capital balance each month. This is different from an interest only loan where only the interest due is paid each month and the outstanding loan balance remains the same.

Your monthly mortgage payment is calculated as the fixed payment amount that will reduce the outstanding balance to zero over the loan term based on a number of simplifying assumptions (no change in interest rates, equal monthly periods, etc.). Because the capital balance of your loan is the highest at the beginning of the loan the portion of your monthly payment that is allocated to interest is initially greater than the portion that is allocated to capital. Over time as your loan balance reduces the portion of your monthly payment that covers the interest will reduce and, correspondingly, the amount allocated to capital will increase.

A very simple illustration of this can be seen by looking at the first 3 payment periods in a hypothetical 15-year loan with a balance of £25,000, an initial fixed rate of 8.9% and initial monthly payment of £252.08.

| Period | Days | Start balance | Payment | Interest | Capital | End Balance |

| 1 | 30 | £25,000.00 | £252.08 | £182.88 | £69.20 | £24,930.80 |

| 2 | 31 | £24,930.80 | £252.08 | £188.45 | £63.63 | £24,867.16 |

| 3 | 30 | £24,867.16 | £252.08 | £181.91 | £70.18 | £24,796.99 |

As set out in the illustration above, in the first month if the period is 30 days long the interest accrued will be £182.88 (£25,000.00 * 8.9% * 30 / 365 = £182.88) which means £69.20 (£252.08 – £182.88 = £69.20) of the monthly payment will be applied to reduce the capital balance. In the second period the interest accrued is slightly higher because the month has 31 days and in the third period the interest is slightly lower for the 30 day period because the capital balance is decreasing. It is important to understand that your loan balance will decrease by the amount of the payment allocated to capital only and not by the total amount of your monthly payment.

The proportion of your payment which is applied to interest will be initially greater if your loan term is longer and lower if your loan term is shorter. This means that the longer your loan term the slower your loan balance will reduce over time because of how the calculations work.

Please note that your actual loan balance over time will depend on when you make your payments, any fees or costs incurred and any variations in the rate of interest over the term of your loan. The interest on your loan is calculated on a daily basis based on the current outstanding balance and the rate of interest applicable at that time. Please refer to your loan documentation and loan terms and conditions for complete information.

You will only need to pay an additional interest amount if you move your payment to a date that is later than your next scheduled payment date. This is because your loan accrues interest daily, and each month, a portion of your monthly payment is applied to loan interest based on the number of days in the month and the remainder is applied to reduce the outstanding loan balance. If you increase the amount of time since your last payment was made, then the number of days in the periodic interest calculation will also increase. Any additional interest amount will be determined by 1) your loan balance, 2) your rate of interest and 3) the number of additional days that are added in connection with the payment date change.

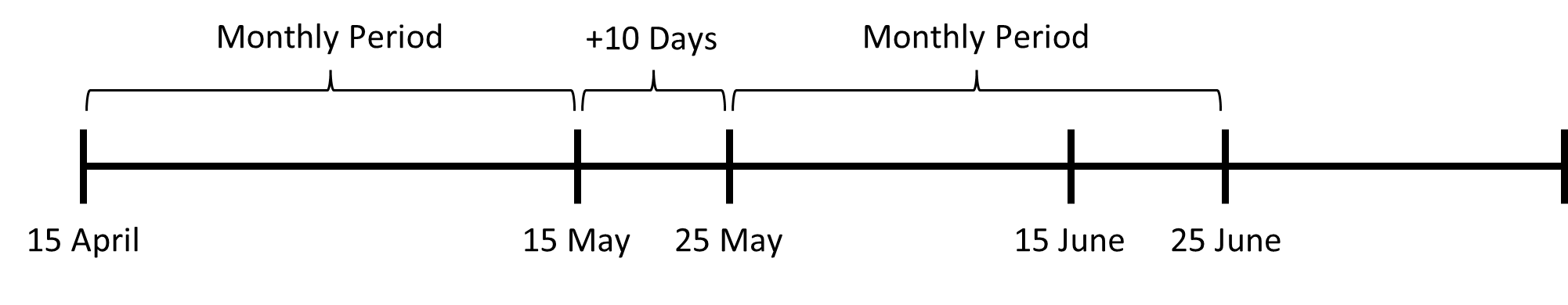

As seen in the example below, if your last loan payment was on the 15th of April and you would like to move your payment date in the next month from the 15th of May to the 25th of May, that will add 10 days to the interest calculation for that payment period.

Assuming a hypothetical loan with a balance of £25,000.00 and an interest rate of 8.9%, each additional day added to a calculation period would add £6.10 (£25,000.00 * 8.9% * (1/365)) to the payment in the period the change is made. This means that if you moved your payment 10 days forward, the additional amount would be £60.96. In the following month, your payment would revert to the standard monthly amount because there will be a normal period from the 25th of May to the 25th of June.

It is important to note that the additional interest amount relates only to the increased number of days in the calculation period associated with moving your payment date forward and does not represent a fee or any form of penalty.

If you are unable to afford the additional interest amount that arises at the time of a payment date change, there are a number of options available which can spread the amount over an agreed period or alternatively increase the term of your loan. Please be aware that making payments later or over a longer period of time can increase your total cost of borrowing.

A. Some of our secured mortgage loans do have early repayment charges and you will also be required to give us 28 days’ notice if you wish to repay your loan early. This is explained in the “early repayment” section of your mortgage offer.

A. Your Step One Finance second charge mortgage is not portable. It will be repaid from the proceeds of the sale of your property, but you may be eligible for a new loan on your next property. You should make an enquiry by contacting us to discuss your new loan requirements with our customer services team on 01483 661 100.

A. Everyone’s circumstances can change, so we will assess your current situation when you call our customer services team on 01483 661 100. If you are having difficulty paying your loan you should do this as soon as you can. Once we know more about your change in circumstances, we will agree the best course of action with you.

Home Improvement Loans

A. You can apply for a Step One Finance personal loan if:

i. You are a homeowner

ii. Hold a UK bank account and receive income in British pounds sterling

iii. Are over 21 years old

iv. Are a UK resident – (personal loans are available to customers in England and Wales)

All loan applications are subject to status.

A. Yes. You have the right to repay all or part of the outstanding balance of your Step One Finance personal loan at any time. Your early settlement figure will include any compensation we are allowed under section 95A of the Consumer Credit Act 1974.

A. The outstanding loan balance is on your annual statement. If this is out of date or you don’t have one, please contact our customer services team on 01483 661 100.

A. You should contact us as soon as possible with your new address details and your loan account number. You should always let us know when any of your personal details change.

A. Yes, when you are approved for a Step One Finance personal loan we will advance the money direct to your bank account.

A. Once you have completed our online application process, your loan will be sent for approval. If we require additional information we will ask for that before we approve the loan. As soon as your loan is approved we will send you a message and pay the money into your account, normally within 24 hours.

A. Our application process is all online and we communicate with you via your email address. You will not be able to proceed without one.

A. It is a requirement for you to be a homeowner for a Step One Finance personal loan.